A Beginners Guide to Forex Trading

Contents

Exchange rates are determined by various factors depending on whether the currencies in question have “free float” or “fixed float”. Obsessing over unsolved questions might lead to a state of befuddlement. As a result, it’s critical not to get carried away by your trading positions and to maintain emotional balance in both profits and losses.

- Balance of Payment- A currency will tend to fluctuate according to its country’s performance with its trading partners.

- Personally, I’m Australian, but I rarely trade the Aussie as I am very comfortable trading the majors for the majority of my trades.

- Obviously the popularity of the internet has helped create this boom as about 99% of all transactions are carried out online.

- On the other hand, if I thought the Aussie was becoming weaker against the US dollar and I wished to sell it, then I would sell it at the BID price of 0.

The ask price is the value at which a trader accepts to buy a currency or is the lowest price a seller is willing to accept. The bid price is the value at which a trader is prepared to sell a currency. Both types of contracts are binding and are typically settled for cash for the exchange in question upon expiry, although contracts can also be bought and sold before they expire.

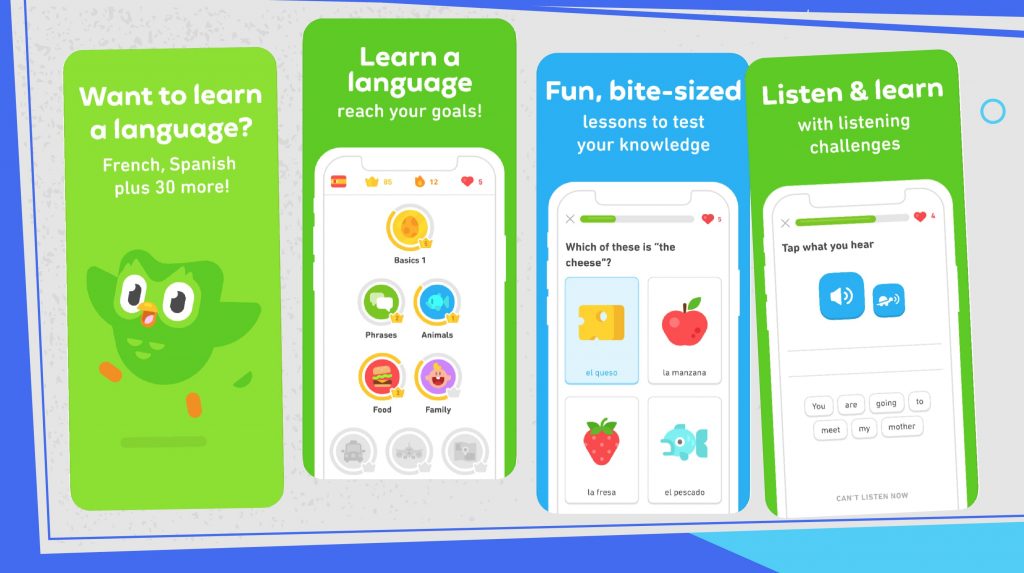

Only if you have the right education can you trade in the forex market. Beginner traders can communicate with accomplished Forex traders through some Forex courses. This enables them to gain practical experience and insightful trading advice. Forex trading generally follows the same rules as regular trading and requires much less initial capital; recession definition economics therefore, it is easier to start trading forex compared to stocks. This makes it easy to enter and exit apositionin any of the major currencies within a fraction of a second for a small spread in most market conditions. Much like other instances in which they are used, bar charts are used to represent specific time periods for trading.

Market

They are not as freely available as custom indicators, but they certainly are becoming more popular. The bid price is 97 and the ask price is 97, and that there is a 2 pip spread. Now there is a difference of 0, which is called the spread, and that would be the amount I lost on this trade. The first currency mentioned is what they call the ‘base currency’ and it is being compared to the 2nd currency, which is called either the ‘quote currency’ or the ‘counter currency’.

One critical feature of the forex market is that there is no central marketplace or exchange in a central location, as all trading is done electronically via computer networks. Once you’re able to successfully create your trading account, protect it. Here are some tips that everyone in the foreign exchange industry could use to help them succeed in the field. Currency future is an exchange traded futures contract to exchange one currency for another at a specified date in the future at a price that is fixed on the purchase date. On the CD segment of the NSE and the BSE, the price of a currency future contract is typically expressed in terms of INR per unit of other currency. For example, the USD-INR future is expressed in terms of rupees per US$ (like 71/$) where the dollar is the principal currency and the rupee is the secondary currency.

High leverages – a double-edge sword:

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. Forex trading is the act of buying and selling currency pairs to profit from a change in their exchange rates. To successfully make money via forex trading in India, you need to correctly predict the exchange rate movements. There are large flows of trade and these occur within the system of currency markets. In the forex markets, traders find it a challenge to influence the prices of currencies. Still, this is the biggest trading market in the world, and if you are a potential investor, it is worth your while to start trading with an armoury of information.

Currency futures are a means for exporters and importers to hedge their risk against adverse currency movements. For example, importers normally go long on USDINR pairs to hedge their risk while exporters go short on USDINR pairs to cover their currency risk. For example, if you sell the USDINR pair, it means you are expecting the US dollar to depreciate in value or the Indian rupee to appreciate in value on a relative basis. All trading of currencies on the NSE and the BSE is for cash purposes only. Any profit or loss on the currency position can be booked and it just impacts your Online Trading profit or loss. As a trader, keep a lookout for formal and informal bank intervention.

You will have to open an account with a regulated broker and gain access to a trading platform such as the one provided by Upstox. Generally, the forex market is most active during the overlap of the two trading sessions, especially the European and North American Sessions. This is because many buyers and sellers are trading currencies during this time. Learn as much as possible about the currency pairs and their characteristics. Understand the difference between the “major” and exotic currency pairs.

The global currency market is dominated by banks and brokers, which can lead to scams, unfair price manipulations, counterparty risks etc. Traditional brokers charge as high as 3-20 pips, way higher than the 1 pip charged in interbank trades. Leverage is simply a short-term loan provided by your broker against the amount in your trading account.

The European nations decided to maintain a single currency which would trade against the US Dollar. Subsequently all the other nations started the free-floating exchange rate determination mechanism against the US Dollar and established the current currency trading system. Put your money with a broker https://1investing.in/ that boasts a good track record and a ton of experience. Start-ups might make for exciting and empowering work environments but play safe with your hard-earned money. When you open an Angel One currency trading account you benefit from over three decades of experience dating back to 1987.

This unit is done and spread each and every subject, steady for the apprentice students and advance level sellers. It has been an incredible time of training and preparation that I have been able to begin to enjoy through this great material. Options trading is a specialty and I needed to have good explanations and learning to get ahead in this business.

Unlimited return potential with less reliance on fundamental analysis:

Samco is one of the best discount brokers in India with a flat brokerage fee of Rs 20 per trade. Apart from this, you need to have a trading account with a SEBI registered currency broker in India, like Samco. There are 3 lot sizes namely, Micro lot ; Mini Lot and Standard Lot . Post World War II, 44 allied nations assembled and decided to create a fixed international currency exchange rate. Since the United States of America had the most gold, all the currencies were pegged against the US Dollar.This system functioned efficiently until the 1970s. As a Forex investor you can make fortune at the Forex market or you can suffer huge losses.

But again, portability, limited supply and divisibility led to the downfall of gold as a currency. Yes, every country issues its own currency which is normally issued by the central bank of the country e.g. RBI in case of India, Federal Reserve in case of the US, and Bank of England in case of UK, etc.

This is something that to their detriment many beginners overlook, currency markets move frequently and rapidly. Knowing what affects these markets and what times volatility is higher can help you avoid these movements or even take advantage of them. Most online brokers will offer leverage to individual traders, which allows them to control a large forex position with a small deposit.

Most international transactions are exchanges of the world’s major currencies. When it comes to Forex trading, there are a number of major currency pairs. Euro v. US dollar, US dollar v. Japanese yen, British pound v. US dollar, and US dollar v. Swiss franc.

Conclusion – Forex Trading

It’s a Unique Community very helpful to all kinds of trader’s beginner’s or pros. The mentors of Fido Markets are so helpful and resourceful, I would highly recommend Fido Markets Courses to someone eager to start Forex Trading Business. Forex Market opens wide opportunities for newcomers to learn, communicate, and improve trading skills via the Internet. Forex is a leveraged financial instrument, as is Options, Futures, CFDs, Warrants etc. Being an Aussie, I use GoTrader or Pepperstone for my MT4 platform and I am quite happy with both of them.

So, every time you buy Pringles from your Kirana store, you are indirectly participating in Forex trading. Forex trading does not involve the risk of loss due to insider trading. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

Basic Principles How Foreign Exchange Markets Work

This is supervised the regulatory authorities and ensures the safety and security of the Forex traders. Of course as an investor you can swap your trade to a subsequent date that can be done on a daily basis or for longer period of time. The foreign exchange market is a crucial part of the global economy.

This is brilliant if you want to try out different trading methods and ideas. Commonly referred to as ‘demo trading,’ there is no reason that you can’t have both a ‘live’ and ‘demo’ account with the same Broker. Most trading is conducted electronically over the internet on your nominated broker’s online account. The cost is minimal for each trade as there is normally no commission involved, however you do have to cover the spread.

The European session is the main session as it normally has the greatest volume traded. You have to remember also that London is the financial capital of the world, even though most people think it is Wall Street in the US. During this time, I have developed and shared many trading systems for free, and I have also assisted many new Traders through my various blogs and forum participation.

Шинэ мэдээ, мэдээлэл

ГЕРОНТОЛОГИЙН ҮНДЭСНИЙ ТӨВИЙН 2024 ОНЫ 5-Р САРЫН ҮЗЛЭГИЙН МЭДЭЭ

2024.06.10

ГЕРОНТОЛОГИЙН ҮНДЭСНИЙ ТӨВИЙН 2024 ОНЫ 5-Р САРЫН ҮЗЛЭГИЙН МЭДЭЭ

2024.06.10

Нээлттэй ажлын байрны зар

2024.06.05

НИЙГМИЙН ЭРҮҮЛ МЭНДИЙГ ДЭМЖИХ ЖИЛ 2024 өдөрлөг Нийслэлийн төв талбайд боллоо.

2024.05.22

ГЕРОНТОЛОГИЙН ҮНДЭСНИЙ ТӨВИЙН 2024 ОНЫ 4-Р САРЫН ҮЗЛЭГИЙН МЭДЭЭ

2024.05.09